Venezuela has the possibility, once again, of being one of the largest oil producing and exporting countries before 2030. To achieve this, it must travel a tortuous path, in which the US sanctions are decisive, as they have an impact on the geopolitical game, influenced by the region’s rapprochement with China and Russia.

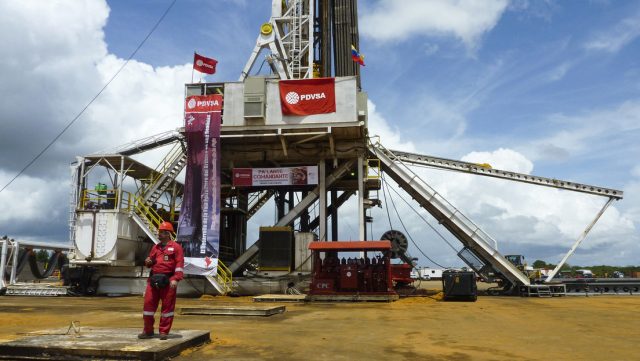

Internally, the situation also requires focus, patience, political will and planning oriented towards economic feasibility. RT spoke with two economists who explained the current state of the State-owned Petróleos de Venezuela (PDVSA) and the difficulties facing the industry amid the blockade and sanctions.

The professor of Petroleum Economics, Carlos Mendozá Pottellá, points out that the situation of the industry, aggravated by the radicalization of sanctions, is also the result of a process of ‘wear and tear’ of decades, which includes the aging of the fields that began to be explored since 1920, as well as a series of supervening circumstances, which are reflected in the deterioration of the refineries.

«It is a long and tended process of deterioration that has worsened», says Pottellá, adding that part of the damage comes from international and pressure and interests, which led the industry to take a path that did not suit it, such as betting everything on the extra-heavy crude resources that are in the Orinoco Belt, before continuing with the complete development of the conventional fields that PDVSA has always worked on.

For Pottellá, this effort to privilege the exploitation of the resources of the Orinoco Belt, which cannot be called reserves until it is economically feasible to extract them. That decision caused maintenance and production in traditional wells to be neglected.

Is there is a solution?

The solution is not easy, says Pottellá: «The first thing that must be recovered is the conventional fields to increase production. There are more than 25,000 traditional oil fields located in Maracaibo, Maturín and Anaco».

The specialist insists that the situation is not resolved overnight and that the projections of producing 5 or 6 million barrels per day are not feasible, as has been held for more than three decades.

In this sense, he adds: «We must also do a gigantic repair and recovery work so that in 4 or 5 years, the country can produce a maximum of 2.5 million barrels per day, which could be maintained for 50 or 60 years».

The main thing – he details – is that the industry be realistic and plan based on what is feasible, which requires making provisions and continually reviewing the projections of the value of crude oil, which in the Venezuelan case – with sanctions and blockade – is lower than that of the international market.

Diversify the Venezuelan economy

Pottellá believes that the country must assume that the era of oil dependence is over and, on that basis, generate a new development perspective that is sustained by a diversified economy. «We have to begin to assume that we are going to stop being oil producers and that we have a country with the capacity to feed 6 countries like ours.»

In addition, he highlights that Venezuelans have «all possible resources outside of oil» to consolidate a «sovereign, upright and capable» country, exporting a diversity of products in different areas: food, textiles, mining and others.

“Venezuela has a population that has a wide culture, knowledge and that is developed, that can easily advance to a prosperous economy, with all the physical and human capacities to be a permanent sovereign country without oil. We can use oil as an aid, but it will never be the source that will guarantee 96% of our imports as it used to do», he said.

On the other hand, the specialist affirms that the economic feasibility should be the fundamental parameter for the oil industry, but considers that this reality has sometimes been neglected by the claims that the price of oil was going to remain eternally above the 100 dollars price».

And, with an oil market so unstable that it presents a price range between 23 to 260 dollars, the principle for the industry is to plan tactfully so as not to compromise production costs. Because of this – Potellá explains – Venezuela cannot continue to focus on the exploitation of the resources of the Orinoco Belt, which were feasible until 2014.

In that particular, he said: «The only condition for the oil from the Orinoco Belt to be labeled as a reserve is that the prices remain above 100 dollars. If the oil goes to 200 and it costs us 40 to get it out, it is feasible, but when prices fall, they cease to be reserves and become resources that must be endured».

How is the production in Venezuela?

For the economist Ingerzon Freites, a member of the Venezuelan Observatory of Economic Reality, the current production capacity, which is between 600,000 and 800,000 barrels per day, according to the latest report from the Organization of Petroleum Exporting Countries (OPEC), is influenced by the supply of condensed crude from Iran.

«These mixtures help to improve the extra-heavy crude that is extracted from the Orinoco Oil Belt», explains Freites about the increase reflected between 2020 and 2021, going from 500,000 barrels a day to 625,000, according to secondary sources cited by OPEC , and the 824,000 according to the direct communication data that the organization refers to.

Although production has increased, the situation continues to be complicated because the industry faces internal situations, which are aggravated by the financial sanctions imposed by the US. In this sense, Freites considers that failures in the electricity supply, theft of equipment, the migration of important technical personnel, the lack of maintenance and the difficulties for investment decisively affect the recovery of the main source of foreign currency for the country.

Regarding the internal supply of fuels, both experts agree that it could be overcome if it is agreed to increase and set a single sale value for gasoline, which would end the duality of prices in force since 2020 and that distributes subsidized fuel with limitations of 0.02 cents per liter; and another called «international», without restrictions, at 0.50 cents per liter.

Pottellá says that for this to happen, the elimination of gasoline subsidies is imminent, as it is the only way to sustain costs. On his part, Freites believes the increase should be gradual and that the subsidies could remain for some sectors of social utility.

What will happen?

Despite the difficult situation, the forecast seems favorable – adds Freites – as the oil gross domestic product is expected to increase over 5% at the end of 2021, which would mean progress «after spending several years in decline and stagnation». This would also be accompanied by the gradual increase in production, which could reach one million barrels per day in 2022.

“As for exports – says Freites – and the price of a barrel of oil from Venezuela, it will depend a lot on the exceptions in the sanctions and on the discount that PDVSA makes to the recipients of these exports, because in order to be able to export today, the industry has to carry out a series of additional operations to get around the blockade, which affects costs”.

Freites also points out that, if production is improved and stabilized, crude oil export earnings could have an increase of between 20 and 30%, which would be extremely important to boost the economy.

For his part, Pottellá maintains that PDVSA, with great efforts and the support of «brash businessmen», can generate a million barrels per day, with a growth rate that in 7 years would allow it to produce between 1.5 and 2 million barrels per day. «With two million we would have an oil industry that can be maintained, that is not a burden for the State and that helps the country», he alleges.

To expedite this scenario – he adds – the industry requires «a gigantic investment» that, based on foreign analysis, could be greater than 200,000 million dollars, an amount that Venezuela does not have and that would force it to seek – in the middle of the sanctions – investment of private capital.

In that scenario, Potellá says, investors would only risk injecting money and facing US sanctions if Venezuela provides highly favorable guarantees and incentives that allow them to quickly recover their funds and make a profit for at least five years in a row.

From this perspective, explains the oil specialist, the industry would benefit – at the beginning – in the operation, since it would have the capacity to produce 2.5 million barrels per day, although it would imply restricting the contributions of the industry to the State until the end of 2027.